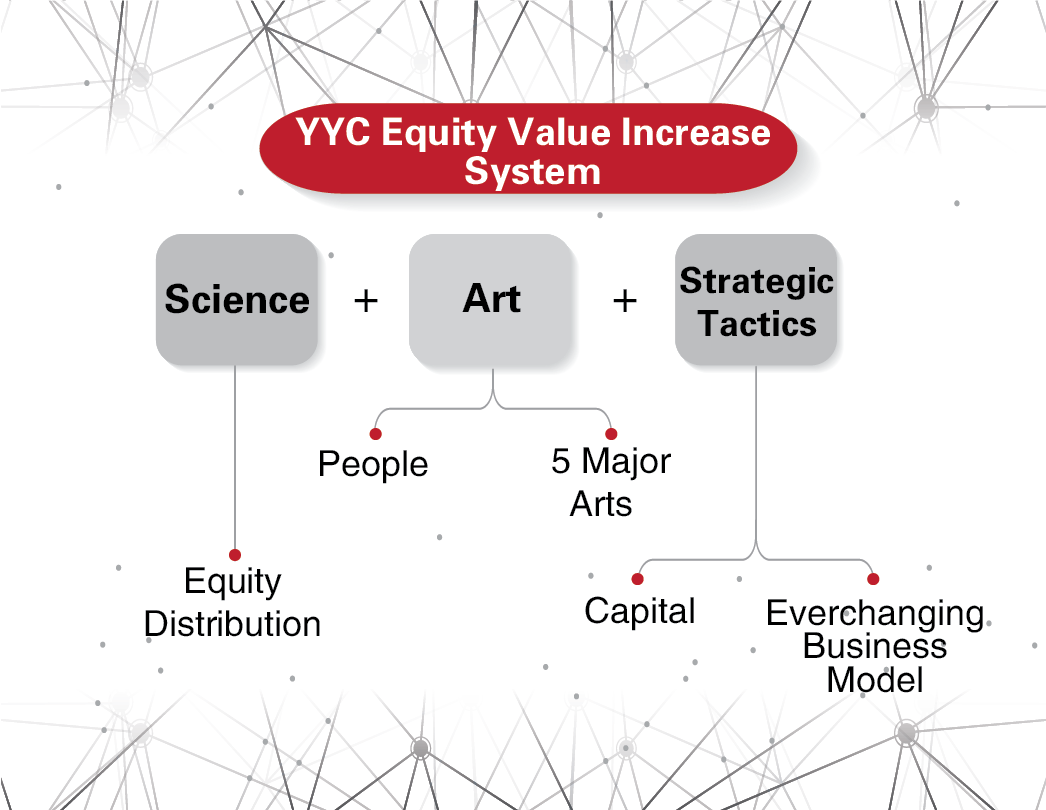

In Malaysia, the YYC Group is a local real-life success story; �in overseas, the success story is Tencent.

Let’s look into the real-life success stories.

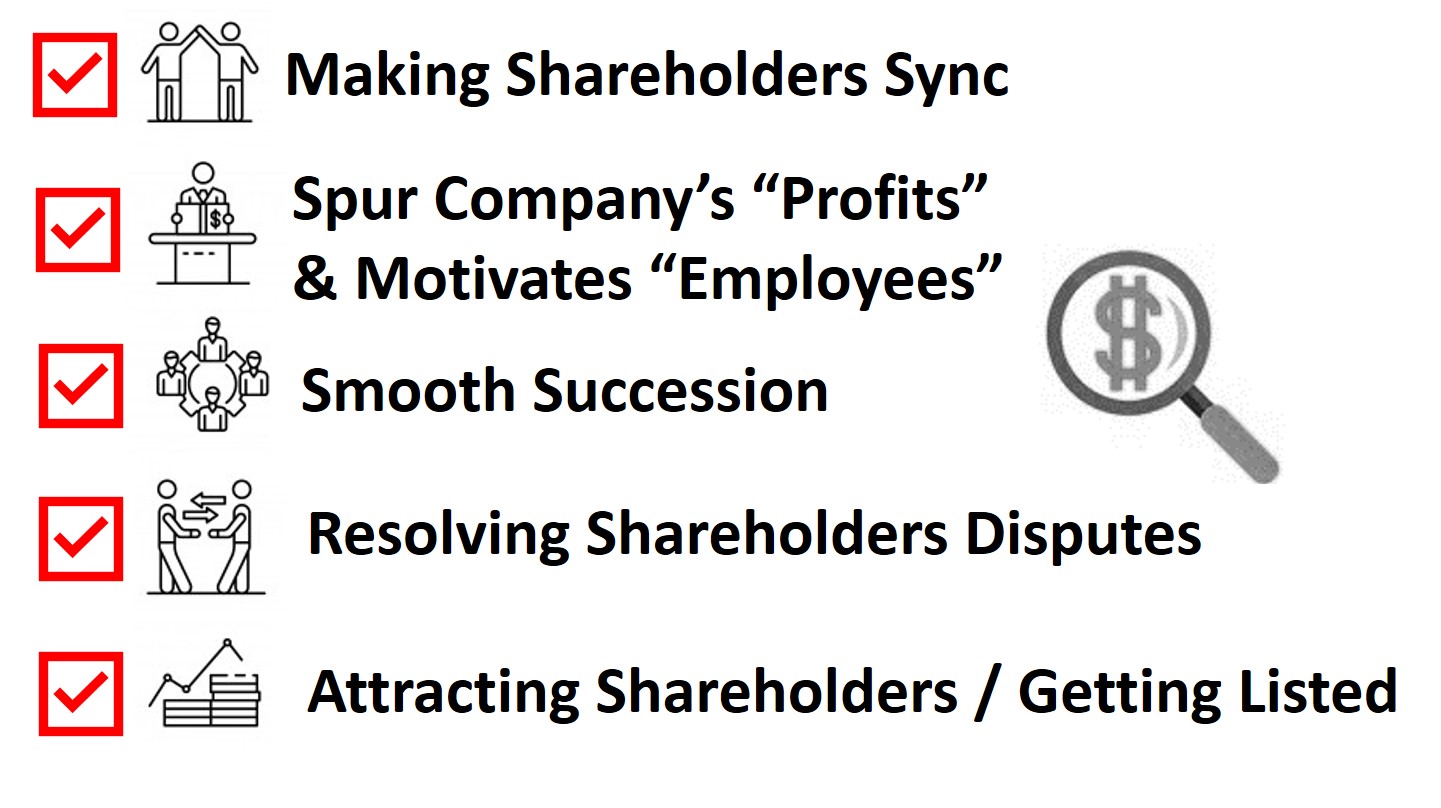

In the case of YYC, the shares are divided equally between the YYC Group Chairman and CEO, as the second generation succeeded the 30 staff accounting firm from the founder and grown into an almost 800 staff group of companies, moreover, YYC Group has also won the attention of OCBC Bank to invest and become strategic partner of YYC in year 2019.

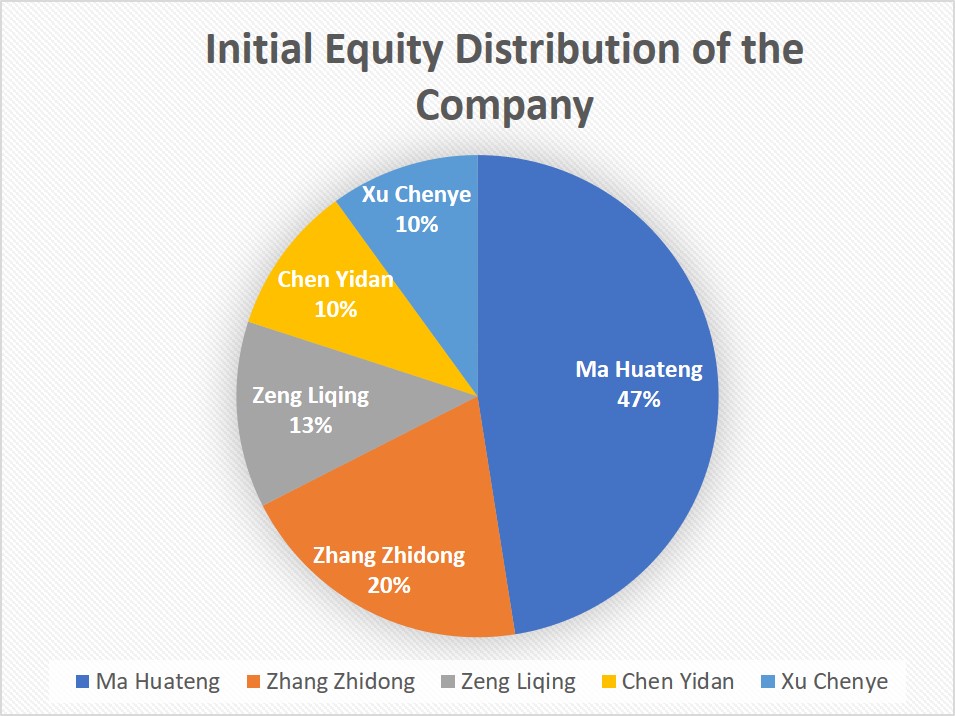

As for Tencent, the key shareholders in Tencent has been through every hard times from the company start-up and equal equity structure with MIH Ventures, their strengths are pulled together to drive the company towards getting listed, as a result, five billionaires and seven multi-millionaires were made. At the same time, MIH Ventures jumped from $60million USD to

$600 million worth in just two years.

From this successful example, it shows that even if your shares are distributed equally between 3 or 4 shareholders, although it may seem that the rights are divided equally, as long as you grasp “high leadership skills + ”Art of Equity Planning” + “Strategic Brain”, you could be the next Ma Huateng of Tencent.

*Note: Tencent upon start-up was only 50,000 RMB, and now the Company PE ratio has increased 45 times, the equity value has even increased to 5.41 trillion HKD.